How a Secured Credit Card Singapore Can Assist You Reconstruct Your Credit Report

How a Secured Credit Card Singapore Can Assist You Reconstruct Your Credit Report

Blog Article

Introducing the Possibility: Can Individuals Discharged From Bankruptcy Acquire Credit Cards?

Understanding the Effect of Insolvency

Upon declaring for personal bankruptcy, people are confronted with the substantial repercussions that permeate various aspects of their economic lives. Insolvency can have a profound impact on one's credit report, making it testing to gain access to credit report or car loans in the future. This financial discolor can stick around on credit report records for several years, affecting the person's capability to protect favorable rates of interest or monetary chances. Additionally, personal bankruptcy might lead to the loss of assets, as particular ownerships may require to be sold off to pay back creditors. The psychological toll of insolvency should not be underestimated, as people may experience sensations of pity, regret, and tension due to their economic situation.

Additionally, personal bankruptcy can restrict employment possibility, as some companies carry out credit scores checks as component of the hiring process. This can present an obstacle to people looking for new task potential customers or career developments. Overall, the impact of bankruptcy prolongs past monetary constraints, influencing numerous facets of an individual's life.

Factors Impacting Charge Card Approval

Following bankruptcy, individuals usually have a low credit history rating due to the adverse impact of the insolvency declaring. Credit report card firms usually look for a credit score that demonstrates the candidate's capacity to handle credit score sensibly. By very carefully taking into consideration these variables and taking actions to restore credit post-bankruptcy, individuals can enhance their potential customers of getting a debt card and working towards monetary healing.

Actions to Restore Credit History After Insolvency

Reconstructing debt after bankruptcy requires a tactical method concentrated on economic technique and regular debt administration. One reliable approach is to acquire a protected credit history card, where you deposit a specific amount as security to develop a credit report limitation. Furthermore, think about coming to be a licensed Resources customer on a family member's credit report card or checking out credit-builder car loans to additional improve your credit rating rating.

Protected Vs. Unsecured Debt Cards

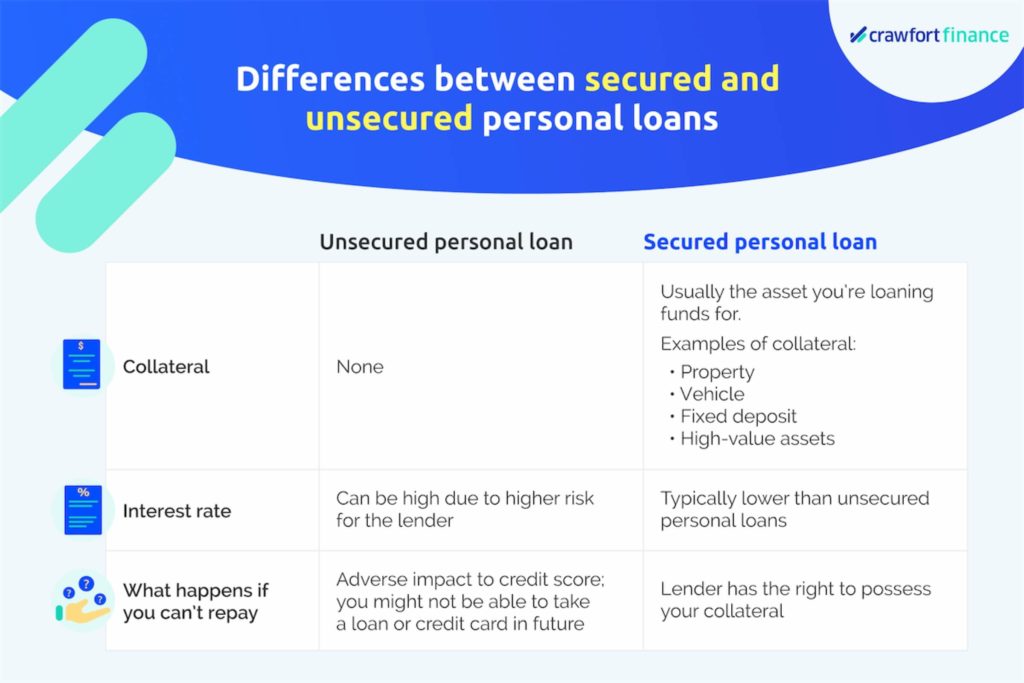

Adhering to personal bankruptcy, people frequently take into consideration the choice in between protected and unsecured credit cards as they aim to reconstruct their creditworthiness and economic stability. Safe credit rating cards need a money down payment that serves as collateral, typically equal to the credit history limit provided. Eventually, the option between secured and unprotected credit report cards should straighten with the individual's economic objectives and ability to manage credit rating properly.

Resources for Individuals Seeking Credit Scores Restoring

One useful source for individuals looking for debt restoring is debt therapy agencies. By functioning with a credit rating therapist, people can gain insights into their credit report records, learn techniques to increase their debt scores, and get advice on managing their finances effectively.

An additional practical source is credit score surveillance solutions. These services allow individuals to keep a close eye on their credit records, track any kind of errors or adjustments, and discover prospective signs of identification burglary. By checking their debt consistently, individuals can proactively deal with any kind of problems that may ensure and emerge that their credit rating details is up to day and exact.

Moreover, online devices and resources such as credit rating simulators, budgeting apps, and monetary literacy websites can give individuals with useful information and tools to assist them in their credit reconstructing trip. secured credit card singapore. By leveraging these resources successfully, individuals released from bankruptcy can take significant actions in the browse around these guys direction of improving their credit health and wellness and safeguarding a better financial future

Final Thought

In verdict, individuals discharged from insolvency might have the opportunity to acquire bank card by taking steps to reconstruct their credit rating. Aspects such as credit scores income, debt-to-income, and background ratio play a substantial function in credit card approval. By recognizing the influence of personal bankruptcy, picking in between secured and unprotected bank card, and utilizing resources for credit history restoring, people can enhance their creditworthiness and possibly acquire access to charge card.

By functioning with a credit rating counselor, people can acquire understandings right into their credit rating reports, learn strategies to improve their credit ratings, and obtain guidance on managing their financial resources efficiently. - secured credit card singapore

Report this page